Asset Verification

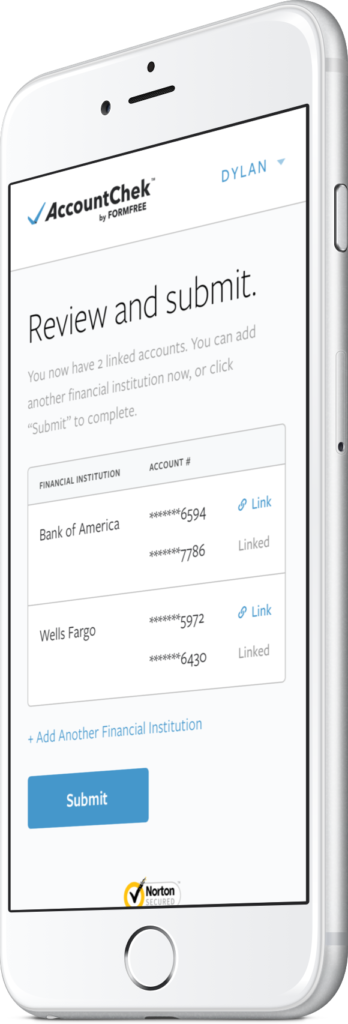

With the click of a button, Our VOA service eliminates the need to collect the bank and brokerage statements required for each borrower. Asset information is collected directly from the consumers financial institutions using bank level security procedures.

Accessible around the clock for your borrowers’ convenience where they may add additional accounts at any time, with the ability to request asset update reports. Submit data with confidence due to the bank level security procedures with state of the art encryption.

- Retrieves digital account statements needed for your loan applications – no faxing, scanning, or emailing, therefore less opportunity for a breach of information during transfer. Also reduces the risk of human error as well as the possibility of fraud.

- Bank level security procedures: submitting data via our system is significantly more secure than faxing, emailing or mailing copies of account statements, with state of the art encryption and credentials that are never visible to anyone

- Day 1 Certainty: gain relief from reps and warrants by using our credit product through Fannie Mae DU

- Up to the minute asset verification that is also accessible around the clock so your borrower can access it when it is most convenient for them, in a discreet fashion

- Request asset update reports with no borrower involvement needed, or borrower may add additional accounts at any time while the order is still open